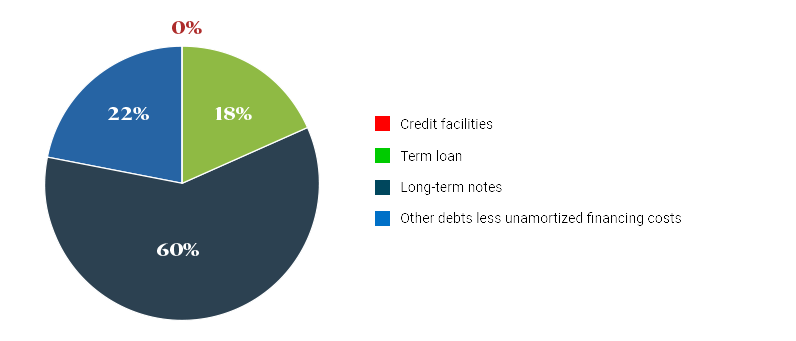

Debt Structure

(As at December 31, 2025)

| Rate/Coupon | Maturity | Type | Amount authorized (M CAN$) | Amount drawn or value (M CAN$) | |

Revolving credit facility 1, 2 | Variable rate | 2029 | Secured | 750 | 2 |

| Long-term notes | |||||

| US $445 million | 5,375% | 2028 | Unsecured | 614 | |

| US $400 million | 6,750% | 2030 | Unsecured | 549 | |

| Term loan of US $260 million | Variable rate | 2027 | Secured | 357 | |

| Lease obligations of subsidiaries | 207 | ||||

| Other debts of subsidiaries | 14 | ||||

| Lease obligations without recourse to the Corporation | 53 | ||||

| Revolving credit facility without recourse to the Corporation | 2028 | 156 | |||

| 1,952 | |||||

| Less: Unamortized financing costs | 8 | ||||

| TOTAL LONG-TERM DEBT | 1,944 | ||||

| Less: Current portion | 70 | ||||

| LONG-TERM DEBT | 1,874 | ||||

| TOTAL DEBT | |||||

| Total long-term debt (including current portion) | 1,944 | ||||

| Bank loans and advances | 0 | ||||

| 1,944 | |||||

| Less: Cash and Cash equivalents | 48 | ||||

| NET DEBT CONSOLIDATED | 1,896 | ||||

| |||||

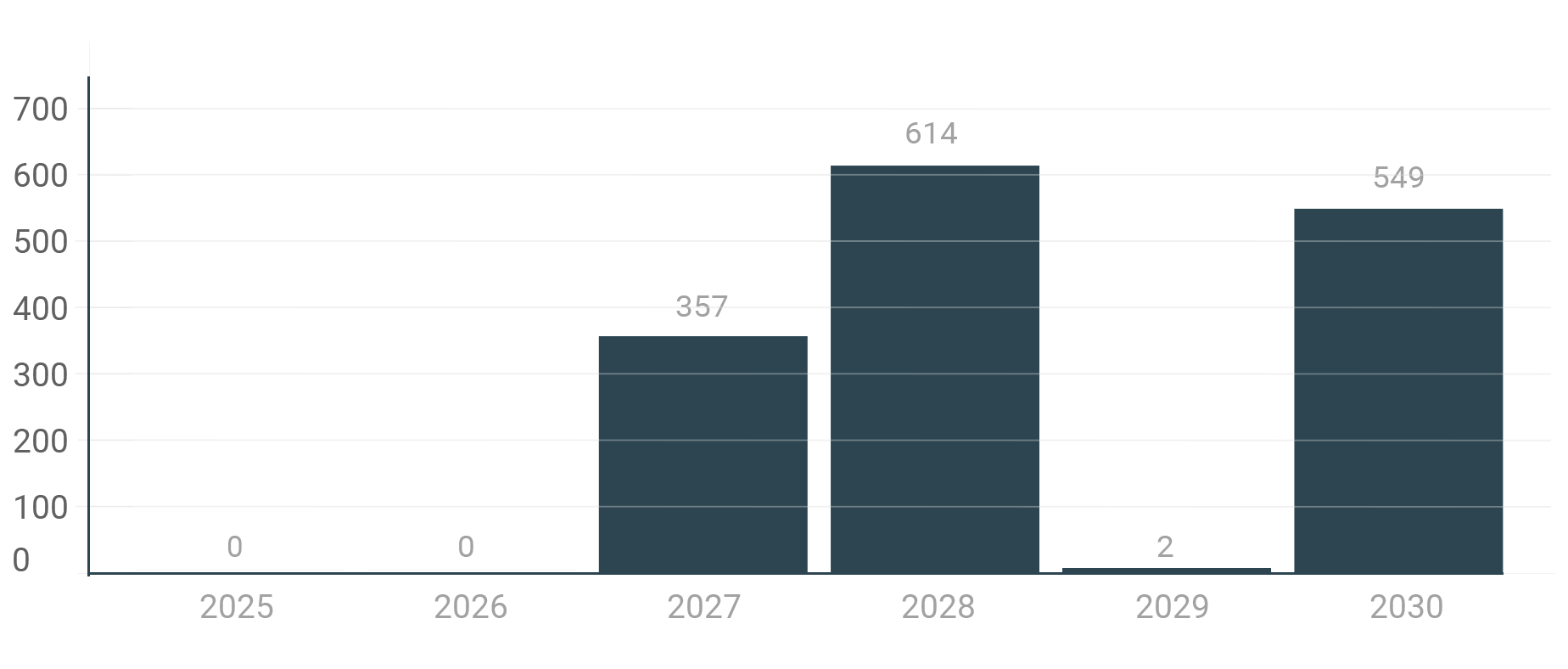

Long Term Debt Repayment Schedule

The estimated aggregate amounts of repayments on long term debt, excluding the other debts of subsidiaries and without recourse to the Corporation, for the next six years are as follows:

(M CAN$)

Current credit ratings as of June 30, 2025

| Moody's | Standard & Poor's | |

|---|---|---|

| Senior secured debt | Baa3 | BB+ |

| Senior unsecured debt | Ba2 | BB- |

| Corporate rating | Ba3 (stable) | BB- (negative) |

Cascades’ credit rating is determined by Moody’s and Standard & Poor's. These ratings are provided for information purposes only and may be modified at any time. The opinions, views or forecasts of these firms regarding Cascades’ performance are distinct from those of Cascades' management.

Main debt documents

For further information on Cascades' credit facility and senior notes (including financial covenants), refer to the following documents:

Available in PDF format

- Cascades - Senior Notes – Due 2028 (1.2 Mo)

- Cascades - Senior Notes – Due 2030 (1.4 Mo)

- Fourth-Amended-Restated-Credit-Agreement (0.5 Mo)